The partnership between Foresight and Williams Advanced Engineering is unique in the EIS and VCT space. Andy Bloxam manages this area for Foresight and he gives us an insight into this unique relationship.

We start off by discussing how the relationship came about, and how it works in practice. We dig into how it has evolved over time, how Foresight and Williams balance their relative strengths and its set up to avoid an extractive relationship.

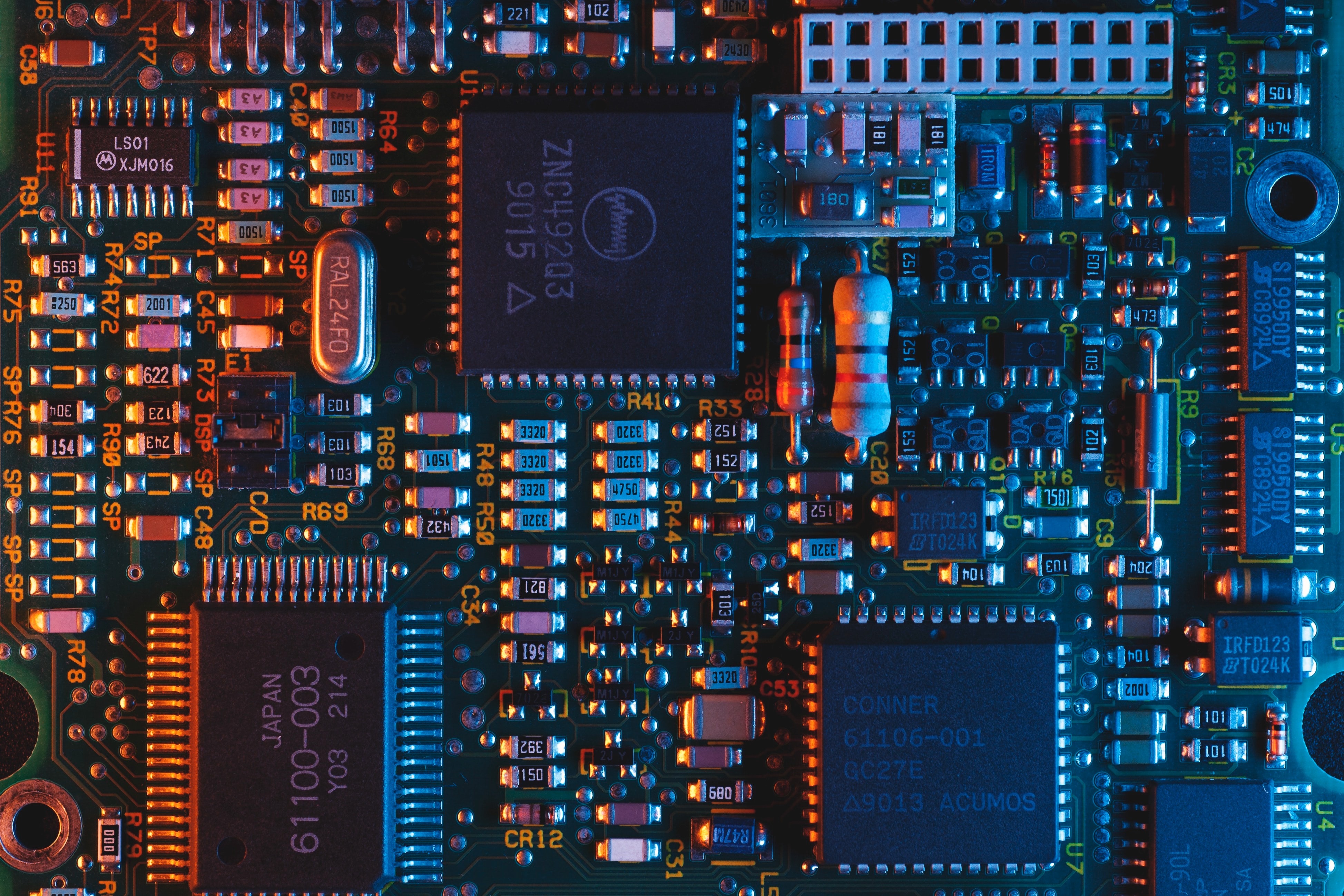

Given the emphasis on deep tech, we also discuss investing in hardware. We talk about the evolving landscape, how technology is affecting lead times and the challenges of testing markets and first customers in this area. Finally, Andy gives one of the most innovative ideas to improve the EIS and VCT market that we have had on the podcast!

Please email enquiries@hardmanandco.com if you have any questions or comments on The EIS Navigator.

Never miss an episode – click here to subscribe to The EIS Navigator on most popular services.

Great by Choice by Jim Collins and Morten T. Hansen

Andy Bloxam at Foresight Group joined Foresight’s Private Equity team in 2018 and is a Director in the London office. His primary responsibility is sourcing, making and managing investments on behalf of the Foresight Williams Technology EIS and VCT funds. Prior to joining Foresight, Andy spent more than 15 years advising and investing in early-stage UK technology companies. Most recently, he was a Director at Committed Capital, a tech-focused private equity and advisory firm. Prior to that, he was an Associate at Strata Partners, a tech-focused corporate finance advisor, and previously an investment banking analyst at JPMorgan, as part of the tech M&A team. Andy holds a BA in Economics from the University of Cambridge and an MBA with distinction from Surrey Business School.

Disclaimer

Please note this podcast/interview does not constitute a financial promotion and is provided for informational purposes and should not be construed as an invitation or offer to buy or sell any investments. Please be aware that investments into unquoted companies are high risk, long term and illiquid investments. Your capital is at risk. Past performance is not a reliable indicator of future performance. Target returns are not guaranteed and forward looking statements are illustrative only and must not be relied upon. Investors should only invest on the basis of reading the full offer documentation. Listeners must make their own independent decisions and obtain their own independent advice regarding any information, projects, securities, tax treatment or financial instruments mentioned herein.