The power law is something that most venture capital investors are aware of, but usually only in the most general sense. Graham Schwikkard, CEO of SyndicateRoom, has just written a white paper on the topic using their data-driven approach.

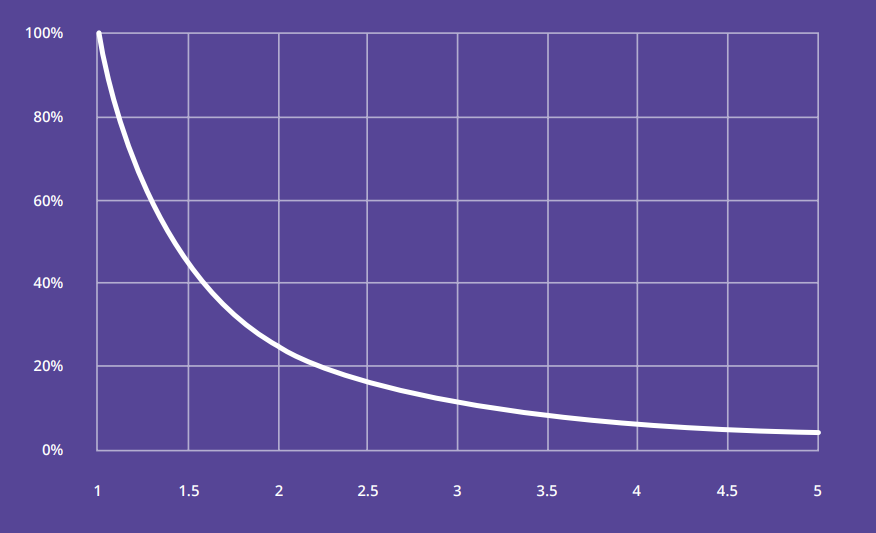

We start on a bit of background, discussing what the power law is and what motivated the paper. Graham then explains how they approached the data, what decisions they made in their analysis and why. Fortunately it did show that returns fit a power law.

We then go into what effect this should have on investors and, most particularly, how they should build a portfolio. We discuss how the characteristics of the power law mean that returns can improve alongside diversification. We also discuss what this says about stock selection and spray and pray approaches. Graham also talks about how different stages of investment give slightly different results and how that influences their investment strategy.

Please email [email protected] if you have any questions or comments on The EIS Navigator.

Never miss an episode – click here to subscribe to The EIS Navigator on most popular services.

Read our Hardman & Co’s latest investment research on SyndicateRoom funds here.

Visit the SyndicateRoom website here.

Read SyndicateRoom’s white paper on the power law.

The Food Lab by J. Kenji López-alt

Brian also mentioned The Power Law by Sebastian Mallaby

SyndicateRoom CEO Graham Schwikkard has over a decade of experience with data science and working with large datasets. He has a fascination with the dynamics of the startup investment network and, after coming across the Companies House dataset in 2017, he spent many hours designing much of the analysis behind the Access Fund. Graham would like to see Access become a vehicle for delivering efficient capital throughout the network, and increase the odds of the system producing more Unicorns and economic growth. Prior to working at SyndicateRoom, Graham spent seven years as a management consultant, and has significant experience of helping companies develop market strategies and optimise business models. He also has in-depth technical expertise, focused on maximising efficiency.

Read the latest research Access EIS Fund.

Disclaimer

Please note this podcast/interview does not constitute a financial promotion and is provided for informational purposes and should not be construed as an invitation or offer to buy or sell any investments. Please be aware that investments into unquoted companies are high risk, long term and illiquid investments. Your capital is at risk. Past performance is not a reliable indicator of future performance. Target returns are not guaranteed and forward looking statements are illustrative only and must not be relied upon. Investors should only invest on the basis of reading the full offer documentation. Listeners must make their own independent decisions and obtain their own independent advice regarding any information, projects, securities, tax treatment or financial instruments mentioned herein.