Within the now 26-strong Infrastructure Investment Companies (IICs) and Renewable Energy Infrastructure Funds (REIFs) sector, most of the constituents have floated within the past decade, with many IPOs undertaken in the lead-up to COVID-19. Subsequently, however, it has been distinctly quiet on the IPO front, as sector NAVs have fallen back, due mainly to persistent higher interest rates. Instead, many REIFs, in particular, are seeking either to sell themselves, or at least some of their key assets.

Sector fundraising, via the equity markets, has been almost non-existent of late. Instead, for most of the IICs, consolidation has been to the fore – the debt-laden Digital 9 Infrastructure is an exception, as it is in Managed Wind Down (MWD).

For most REIFs, retrenchment has been very much the order of the day – not surprisingly, share buybacks have been popular among the leading stocks. Moreover, aside from Hydrogen Capital Growth, which is in Managed Realisation (MR), there are four REIFs in MWD, excluding Triple Point Energy Transition, whose liquidation has now been completed – surprisingly quickly and without serious problems.

This pronounced reversal has seen the optimism of the early 2020s drained from the sector, as the significant premia over NAVs, at which most stocks then traded, converted into heavy discounts. There are exceptions, although even the highly rated 3i Infrastructure is trading at a discount of ca.10% currently.

Whereas, previously, equity markets generally welcomed fundraises, this is no longer the case, with few of the 26 stocks under review seeking – actively at any rate – to raise new funds. In the current climate, very few have a realistic chance of securing substantial new funds from equity markets.

Instead, under strong institutional shareholder pressure, the focus has moved sharply to share buybacks, which have been undertaken by many of the leading REIFs. With few attractive investment opportunities – at current market valuations – undertaking share buybacks is the obvious safe option.

Even so, the larger IICs ‒ such as 3i Infrastructure, the sector’s outlier – continue to prosper, albeit at somewhat lower valuations. Similar comments apply to both Cordiant Digital Infrastructure and Pantheon Infrastructure, both relative newcomers to the sector.

The two largest REIFs ‒ Greencoat UK Wind and TRIG ‒ are also well-placed; especially the former, which is focused, almost entirely, on UK wind generation. TRIG, however, with considerable EU investment, has faced some challenges: its solar load factor in 2024 in GB and France was a paltry 11%.

The heavy discounts to NAV at which some stocks are trading ‒ notably those applying to Digital 9 Infrastructure and to Hydrogen Capital Growth, at a near 70% discount in each case ‒ sum up the poor market sentiment. Even some REIFs, with decent operating records, find that the market is currently applying discounts of ca.30% on their stock.

Undoubtedly, high interest rates, which may not come down in line with market expectations, and their impact in driving up discount rates, have cut valuations ‒ a scenario to which markets have reacted accordingly. There is a widespread belief, often expressed by frustrated IIC/REIF executives, that it is macroeconomic factors that are driving NAV discounts. After all, when the yield on ultra-safe government gilts is above 4.5%, as is the case currently, yields on IICs/REIFs, which have to reflect the various risks to which they are exposed, are driven higher.

Given this background, sector casualties have been inevitable, mainly brought about by failed Continuation Votes from disenchanted shareholders, which generally lead to the sale of core assets and eventual liquidation.

Aside from Atrato Onsite Energy, which was taken over at the end of last year by the Brookfield/RAIM joint venture, five sector stocks – Aquila Energy Efficiency, Aquila European Renewables, Digital 9 Infrastructure, Ecofin US Renewables Infrastructure, and VH Global Energy Infrastructure ‒ have entered MWD. To date, only Triple Point Energy Efficiency has completed the MWD process ‒ with surprising ease ‒ and it has subsequently been delisted.

By contrast, SDCL Efficiency Income, which is also planning to sell off surplus assets – for the prime purpose of generating cash – is faced with owning a wide portfolio of assets, many of which are subject to detailed contractual obligations. In fact, SDCL Efficiency Income has managed to sell its United Utilities’ renewable energy business at a price that broadly equated to that paid on its acquisition in 2022. However, its intended sale of Onyx has been derailed by the profound uncertainty caused by the US government’s planned tariff changes.

Among the IICs, Digital 9 Infrastructure struggled to sell its core Verne Global business, completion of which was finally confirmed in a pivotal RNS announcement in March 2024. It is now engaged in selling off its remaining assets, effectively its 48% stake in Arqiva, which is faced with many uncertainties in the UK broadcasting market ‒ a poignant end to the dreams that its founders cherished when undertaking Digital 9 Infrastructure’s IPO in March 2021 and subsequently raising more than £900m of equity funds.

Gore Street Energy Storage recently faced down a Continuation Vote, but other similar initiatives are expected in the sector. It should be noted that, even Greencoat UK Wind, the REIF sector bellwether, faced a Continuation Vote at its AGM in April 2024, with only 11% of its shareholders voting against the motion. For those REIFs, with larger share price discounts to NAV, the number of dissentients may be markedly higher.

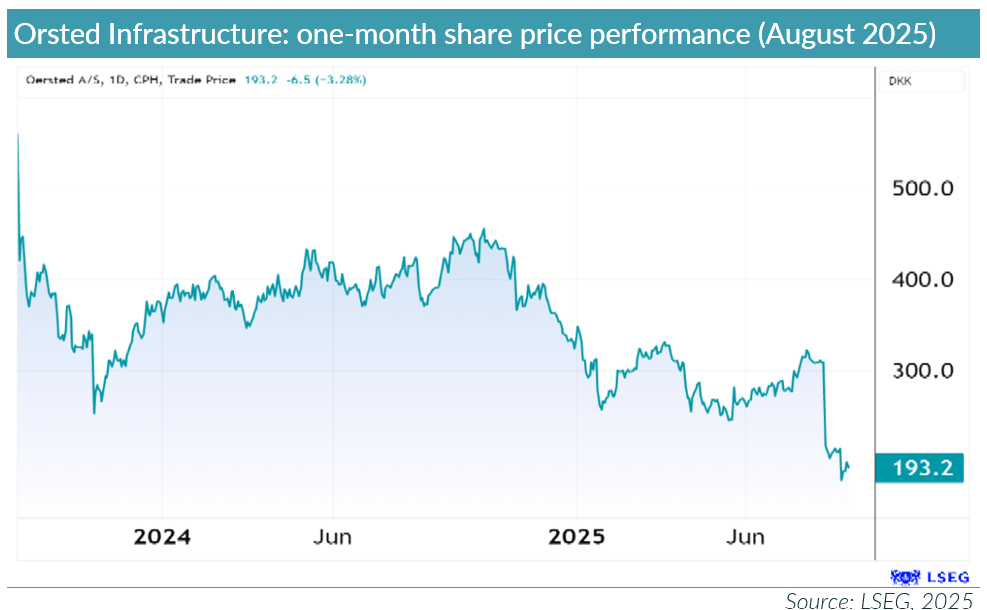

Among the larger renewable energy players, shares in Orsted, the EU’s leading renewable energy business, were rocked by its ca.£7bn right issues announcement – way ahead of market expectations. The US government ordered work to be stopped on the Revolution Wind plant, which was 80% complete. The damage to Orsted’s share price is highlighted below.