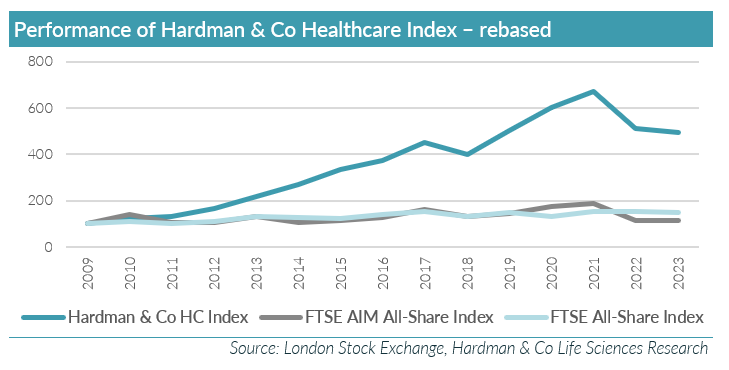

The Hardman & Co Healthcare Index (HHI) has been running since 2009. Its main function is to highlight the attractions of life sciences investments over the long term. For the second year running, apart from global economic influences affecting world markets, performance in 2023 was dented by the capital-intensive nature of the sector. The HHI fell 3.7%, to 483.8, underperforming the main London markets – FTSE 100 (+3.8%) and FTSE All-Share (3.8%) but outperforming the FTSE AIM All-Share Index (-8.2%). Only 15 companies in our index saw share prices rise in 2023, four of these benefiting from trade sales. Despite challenges in raising new capital from the market, 15 companies (29%) did achieve successful outcomes. A number of companies are short of cash and will need more capital in order to get auditors to sign off their accounts – so 2024 looks as though it will be busy again.

Watch our video interview on the subject here.

Download the full report