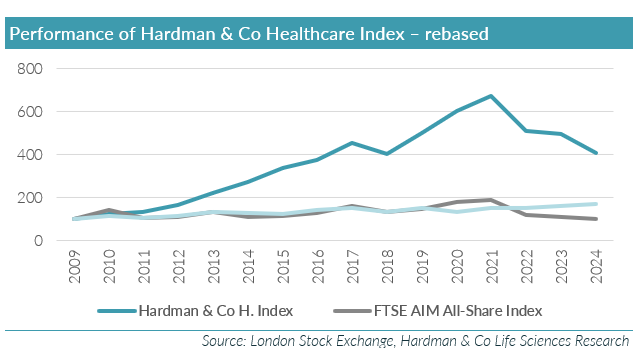

The Hardman & Co Healthcare Index (HHI) has been running since 2009. Its main function is to highlight the attractions of life sciences investments over the long term. For the third year running, despite generally good returns in global markets, particularly in the US, performance in 2024 was poor, not helped by the capital-intensive nature of the sector. The HHI fell 17.7% to 398.9, underperforming all its benchmarks – FTSE 100 (+5.7%), FTSE All-Share (5.6%) and the FTSE AIM All-Share Index (-5.7%). Only 11 companies in our index saw share prices rise in 2024. Despite challenges in raising new capital from the market, 37 UK-listed companies raised £557m last year. Having raised this working capital, we highlight a number of companies looking to generate sales traction from commercial activities in 2025.