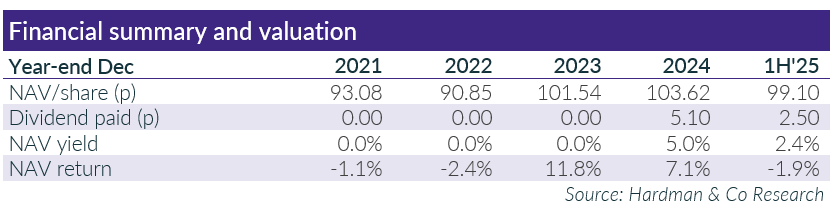

The Blackfinch Spring VCT will give investors exposure to a range of growth-stage, technology-enabled investments. It is targeting a dividend yield of 5%, with special dividends if realisations permit.

Download the full report

If you'd like to be introduced to the team at Blackfinch Investments (Fund), get in touch.

Request a meeting