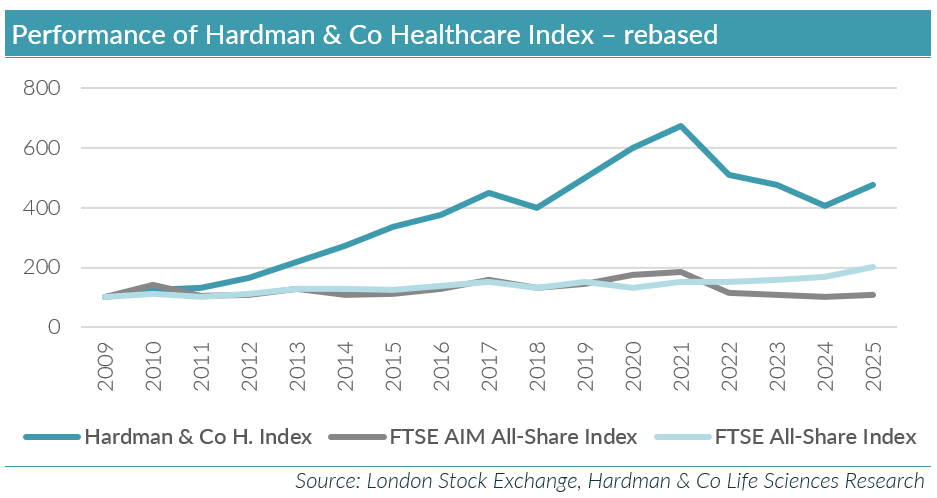

The Hardman & Co Healthcare Index (HHI) has been running since 2009. Its main function is to highlight the attractions of life sciences investments over the long term. After three years of annual declines, the HHI rebounded 17.6% to 469.1 in 2025. While this sounds positive, it was below the strong performance of most major UK healthcare stocks and, in general, it underperformed its UK and peer benchmarks: FTSE 100 (+21.5%); FTSE All-Share (+19.8%); and the NASDAQ Biotech Index (NBI; +32.4%). The HHI outperformed only the FTSE AIM All-Share Index (+6.5%). 19 (39%) companies in our index saw share prices rise in 2025. Raising new capital appeared more challenging, 38 (37) UK-listed companies raised £266m (£557m) in 2025, while nine companies delisted primarily due to low valuations.