By Dr Martin Hall

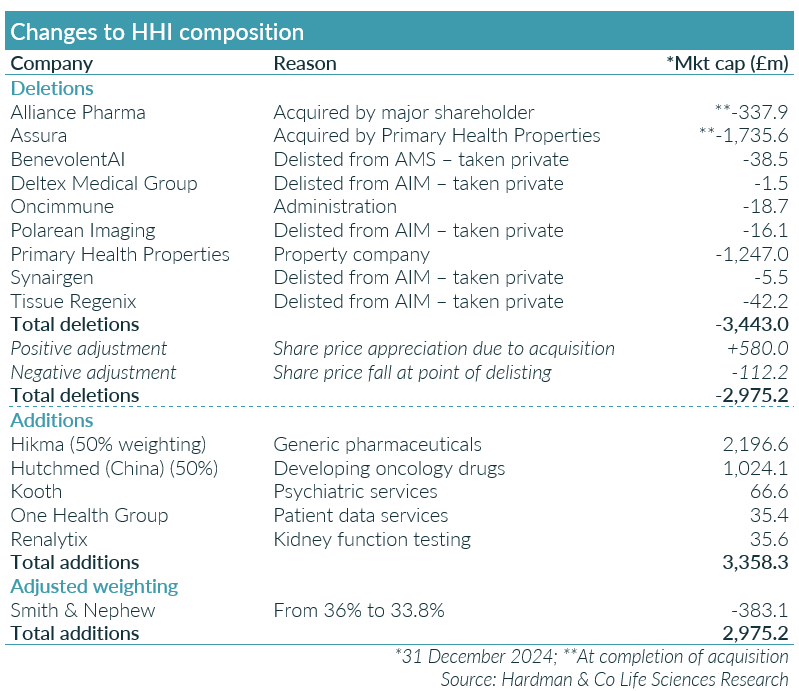

As seen in previous years, there have been some enforced changes to the composition of the HHI following a number of M&A transactions, delistings to become private again and, unfortunately, some companies going into administration. During 2025, there were five M&A deals completed, the largest being the acquisition of Assura Group (AGR.L) by Primary Health Properties (PHP.L) after a prolonged battle with a private equity group. We have taken this opportunity to replace PHP in our index, as it is essentially a property company rather than a healthcare company, albeit it does provide premises for healthcare providers. Moreover, we had some additional unexpected changes during the year, with 11 healthcare companies delisting – not all of these were included in our index – and becoming private again as a consequence of finding it difficult to raise new capital at sensible valuations, and two companies, unfortunately, going into administration. Overall, we have replaced nine companies with a combined market capitalisation of £2.86bn (at 31 Dec 2024; £3.44bn less the £0.56bn M&A appreciation by the date of completion), representing 14.5% of the index, as shown in the following table.